is mortgage life insurance a good idea

It could be surprising; however, knowing who has recently purchased a house can be a public record. The information on who bought or refinanced mortgages for homes and the lender, the loan amount, and the address to which the loan is tied can be found in the local courthouse. The companies will offer life insurance and mortgage protection to prospective homeowners.

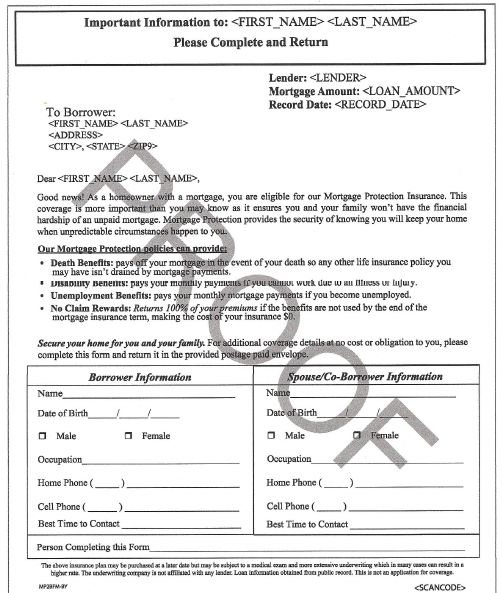

If you've recently refinanced or bought your first home, you can expect to receive multiple offers from companies that sell mortgage protection insurance. Some of these offers may be frauds.